Digitale Signatur: Anbieter

Einfach, sicher und einsatzbereit ab Tag 1

Von HR bis Geschäftsleitung: Unterschreiben Sie Ihre Dokumente elektronisch mit wenigen Klicks auf der führenden E-Signatur-Plattform aus der Schweiz.

Endlich effizient arbeiten:

- Verträge 10x schneller abschliessen

- Direkt starten, keine Installation nötig

- Weltweit rechtsgültig und sicher

Die erste Wahl von über 3.000+ Unternehmen in ganz Europa

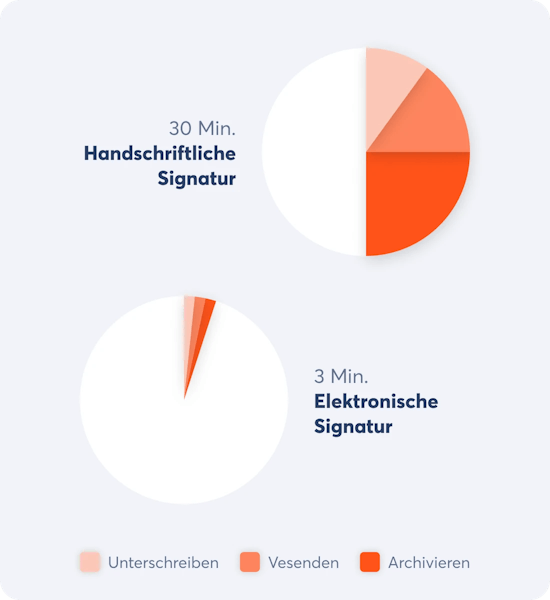

10x schneller abschliessen

Unterschreiben Sie jedes Dokument in 3 statt 30 Minuten.

Nahtlos digitale Prozesse

Ausdrucken und Einscannen gehören der Vergangenheit an. Sie verschlanken alltägliche Prozesse und reduzieren Medienbrüche.

Von überall signieren

Postversand oder Extrafahrten ins Büro entfallen: Alle Parteien signieren sicher und ortsunabhängig mit dem Smartphone, Tablet oder am Computer.

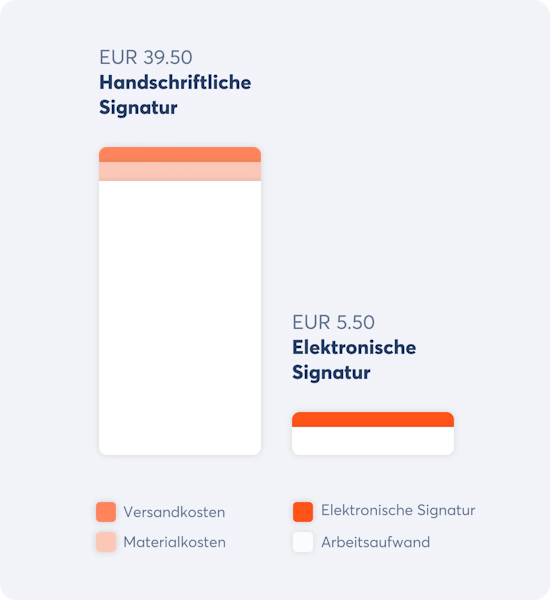

Kosten um 90% reduzieren

Sparen Sie EUR 34 pro elektronisch signiertem Dokument.

Weniger Aufwand

Kein Scannen, Drucken, zur Post rennen und tagelanges Warten mehr.

Sofort loslegen

Sofort einsatzbereit, ganz ohne Installationen. Für noch mehr Effizienz integrieren Sie Skribble via Plug-in oder modernster API.

Einfachste Anwendung

Die intuitive Benutzeroberfläche macht, dass jeder E-Signing ohne Schulung versteht und gerne nutzt.

50x nachhaltiger wirtschaften

Machen Sie die Welt zu einer besseren. Eine Unterschrift nach der anderen.

100% Papier sparen

2023 haben unsere Kunden über 5.4 Millionen Blatt Papier gespart. Ein Papierstapel, der fast doppelt so hoch ist, wie der Eiffelturm in Paris.

CO2 Emissionen halbieren

Mit der E-Signatur verbrauchen Sie halb so viel CO2 als mit der Unterschrift von Hand. Der Grossteil ist dem papierlosen Arbeiten zu verdanken.

“Was früher mehrere Tage dauerte, ist heute in wenigen Minuten erledigt”

In 3 Schritten elektronisch signieren

1. Dokument wählen

Binden Sie Skribble in Ihre bestehenden Systeme ein oder laden Sie Ihr Dokument auf unsere Onlineplattform hoch.

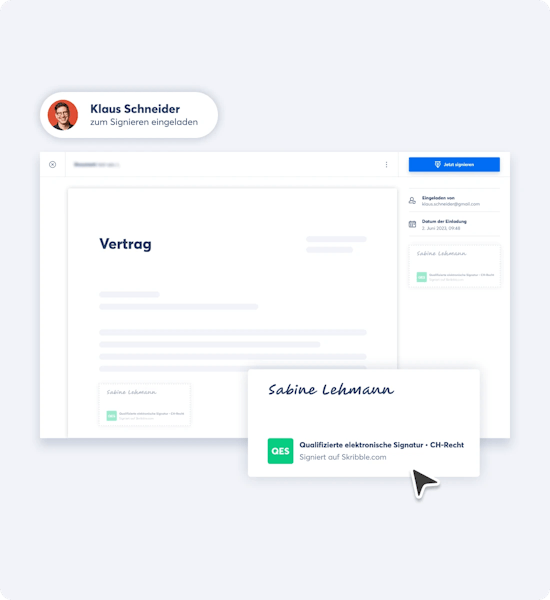

2. Signierende einladen

Signieren Sie selbst und laden Sie Kollegen, Partner und Kunden zum Signieren ein.

3. Auf Knopfdruck signieren

Signieren Sie in wenigen Sekunden elektronisch – auf Mobile, Tablet oder Desktop.

Wieso Skribble?

Maximale Sicherheit

Zugeschnitten auf anspruchsvolle Unternehmen in ganz Europa.

Schriftformerfordernis gemäss BGB

Die qualifizierte elektronische Signatur (QES) ist der handschriftlichen Signatur gemäss Gesetzgebungen in der EU (BGB) gleichgestellt.

Datenschutz gemäss DSGVO

Ihre Daten sind gemäss der europäischen Datenschutz-Grundverordnung (DSGVO) geschützt. Gehostet auf Banken-Level.

Gesetzliche Vorgaben erfüllen

Signieren Sie jedes Dokument weltweit rechtsgültig und sicher nach EU-Recht.

Alle E-Signatur-Standards integriert

Signieren Sie, je nach Dokument, mit der einfachen, fortgeschrittenen oder qualifizierten elektronischen Signatur (EES, FES, QES).

QES nach EU-Recht (eIDAS)

Mit der QES signieren Sie Dokumente mit Schriftformerfordernis und maximaler Sicherheit nach eIDAS.

Lokale Support-Teams

Mit massgeschneiderten Lösungen, fundiertem Praxis-Know-how und lokalem Support begleiten wir Sie auf jedem Schritt.

Wir sprechen Ihre Sprache

Unsere E-Signing-Experten sind in Deutschland und der Schweiz ansässig und sprechen Deutsch, Französisch, Italienisch und Englisch.

E-Signing-Expertise inklusive

Von der Wahl des richtigen Plans bis zum erfolgreichem Roll-Out. Wir sind für Sie da – per Telefon oder E-Mail.

“Wir sind froh, mit Skribble einen Partner gefunden zu haben, der unsere hohen Ansprüche an Datenschutz und Informationssicherheit erfüllt.”

Skribble bringt mehr Effizienz in Ihren Arbeitsalltag

Erfahren Sie, welche Abteilung am schnellsten von der E-Signatur profitiert.

“Mit der E-Signatur sind wir viel produktiver und sparen eine Menge Papier, Zeit und Kosten.”

Mehrfach mit der Bestnote auf folgenden Portalen ausgezeichnet:

Signieren Sie rechtsgültig

mit wenigen Klicks

Weltweit einsetzbar, gehostet in der Schweiz.

Kostenlose Testphase verfügbar.

Keine Kreditkarte nötig.

Nutzbar auf Deutsch, Englisch und Französisch.